Forex Historical Data App is absolutely free for all the traders who want to download Forex data CSV and use it to backtest trading strategies and Robots. Forex Historical Data App is FREE! The Forex Historical Data app is developed to solve one of the biggest problems that the beginner algo traders meet – the brokers do not provide a lot of bars Welcome to blogger.com's Reddit Forex Trading Community! Here you can converse about trading ideas, strategies, trading psychology, and nearly everything in between! We also have one of the largest forex chatrooms online! /r/Forex is the official subreddit of blogger.com, a trading forum run by professional traders 8. · Download Free Forex Data. Download Step 1: Please, select the Application/Platform and TimeFrame! In this section you'll be able to select for which platform you'll need the data. MetaTrader 4 / MetaTrader 5. This platform allows the usage of M1 (1 Minute Bar) Data only. These files are well suited for backtesting trading strategies under

William R Forex Trading Strategy | blogger.com

Most traders look for trading strategies which allow for a very high win ratio with high yielding trades. Yes, that all sounds great and yes that is possible to some extent, but that is very difficult to achieve. What new traders should be aiming for is a strategy which is a good mix of both.

A strategy that allows for a decent win rate and a decent reward-risk ratio. The William R Forex Trading Strategy is one of those strategies that have a decent win rate and reward-risk ratio. At the same time, it also allows traders to catch some of those high yielding trades from time to time. By doing this type of strategy, traders could steadily grow their accounts in the long run.

It is a very responsive oscillating indicator which is the inverse of the fast line of the stochastic oscillator. It then compensates for the inversion by multiplying the value with The oversold territory is below while the overbought territory is above Momentum traders on the other hand would take the exact opposite of the trade signal. They would instead take the direction of the overextension as it starts, expecting for the momentum move to cause a trend.

They would instead take a buy trade when the line crosses above and sell if it goes below Lastly, r forex data, crossover reversal traders would take signals based on the midline which is at Crosses going over are interpreted as a bullish trend direction reversal, while crosses going below it are interpreted as bearish trend reversals.

Moving Average Crossover strategies are probably r forex data of the most basic types r forex data trend reversal or trend following strategies. It is based on the crossing of a faster moving average over a slower moving average. Trend direction is then based on the direction of the crossover. The assumption of this type of strategy is that, since the moving averages are a basis of a trend, whenever the short-term trend crosses over a longer-term trend, the trend direction is assumed to have shifted, r forex data.

The EMA Crossover Signal indicator is a r forex data indicator which provides entry signals whenever it detects crossovers of an Exponential Moving Average. Traders could change the parameters of the short-term and long-term moving average in order to suite their trading strategy. Trades will be taken based on the crossing over of its midline, which is at The EMA Crossover Signal indicator will be used as an entry signal based on the period and period EMA, r forex data.

These entry signals should be somewhat aligned in order for the trade to be considered. This trading strategy is a basic crossover strategy which allows traders to steadily increase their trading account balance. It does this by giving trade signals that have a decent probability of being profitable while at the same time giving a decent reward-risk ratio. Traders r forex data gain anywhere from 1.

It is also best used in conjunction with some price action based strategies, such as breakouts and reversal patterns. This would increase the probability of a successful trade as price action traders would also be taking the same position as traders using crossover reversal strategies. Traders using this strategy should also learn how to properly place stop losses using support and resistances or swing r forex data and swing highs.

This would cause win rates and reward-risk ratios to vary, r forex data. Stop losses that are too r forex data tend to increase reward-risk ratios yet cause r forex data rates to suffer. On the other hand, wide stop losses would lower reward-risk ratios while at the same time improving win rates. Forex Trading Strategies Installation Instructions William R Forex Trading Strategy is a combination of Metatrader 4 MT4 indicator s and template. The essence of this forex strategy is to transform the accumulated history data and trading signals.

William R Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye. Based on this information, traders can assume further price movement and adjust this strategy accordingly. Click Here for Step By Step XM Trading Account Opening Guide. Some templates are already integrated with the MT4 Indicators from the MetaTrader Platform.

Get Download Access. Save my name, email, and website in this browser for the next time I comment. Sign r forex data. your username. your password, r forex data. Forgot your password? Get help. Password recovery. your email. Home Forex Strategies William R Forex Trading Strategy. Forex Strategies. Table of Contents. RELATED ARTICLES MORE FROM AUTHOR. ATR Momentum Breakout Forex Trading Strategy. Notarius Moving Average Oscillator Forex Trading Strategy.

Donchian Channel KVO Forex Scalping Strategy. CCI MA Momentum Breakout Forex Trading Strategy. Gann RSI Forex Trend Following Strategy.

Oracle Move Momentum Forex Trading Strategy. LEAVE A REPLY Cancel reply, r forex data. Please enter your comment! Please enter your name here. You have entered an incorrect email address!

Top Download MT4 Indicators List. Infoboard Indicator for MT4 December 17, Candle Closing Time Remaining Indicator for MT4 R forex data 10, TMA Slope Alerts Indicator for MT4 December 17, MA BBands Indicator for MT4 December 17, Renko Charts Indicator for MT4 November 9, Forex Trading Strategies Explained. Top 5 Best Forex Trend Following Strategies That Work July 22, Forex Strategy — Price Action Strategy Explained With Examples September 23, Top 10 MT4 Indicators That Works Free Download September 25, Forex Stochastic Strategy Explained With Examples October 10, Recommended Top Forex Brokers, r forex data.

Tickmill Broker Review — Must Read! Is Tickmill a Safe April 8, XM Trading Account Opening Guide March 26, FBS Broker Review — Must Read! Is FBS a Safe January 7, XM Broker Review — Must Read! Is XM a Safe November 9, FXOpen Broker Review — Must Read! Is FXOpen a Safe POPULAR POSTS. Recent Posts. ATR Momentum Breakout Forex Trading Strategy April 30, i-Sessions Indicator for MT4 April 29, POPULAR CATEGORY. About Us Contact Us Privacy Policy Disclaimer Forex Advertising.

All rights reserved. MORE STORIES. Tim Morris - April 30, 0.

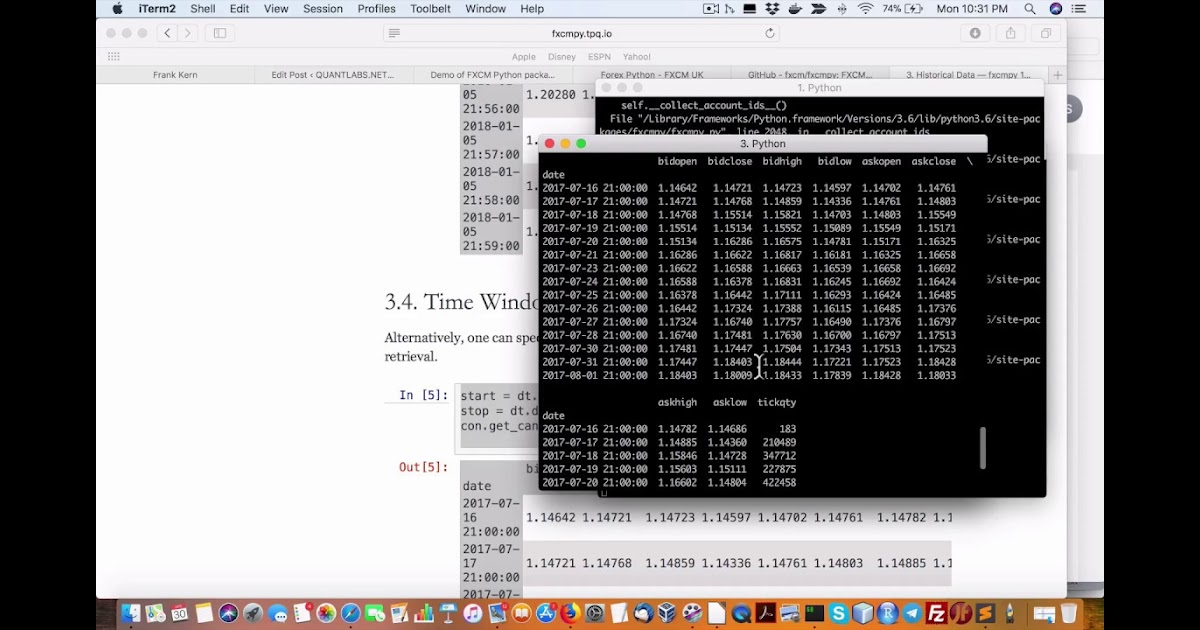

Download FOREX candlestick tick data for FREE using Python

, time: 16:55Free Forex Historical Data: Forex Currency Pairs

Welcome to blogger.com's Reddit Forex Trading Community! Here you can converse about trading ideas, strategies, trading psychology, and nearly everything in between! We also have one of the largest forex chatrooms online! /r/Forex is the official subreddit of blogger.com, a trading forum run by professional traders 8. · Download Free Forex Data. Download Step 1: Please, select the Application/Platform and TimeFrame! In this section you'll be able to select for which platform you'll need the data. MetaTrader 4 / MetaTrader 5. This platform allows the usage of M1 (1 Minute Bar) Data only. These files are well suited for backtesting trading strategies under 7. · Date is the first day of the week (always a Monday) A week is 7 days long (Monday to Sunday) Open is the price on the first day of the week. High is the highest price of the week. Low is the lowest price of the week. Close is the last price of the week. r time-series. share

No comments:

Post a Comment