3-Inside Up/Down Price Action Forex Trading Strategy. The 3 Inside Up/Down forex trading strategy is a trend reversal price action trading pattern that can be spotted at the top or bottom of bullish or bearish trend respective. Trading this price action alongside some custom indicator, does increase the chances of Forex Up and Down Robot. May 13, March 30, by forexearobots. Forex Up and Down Robot review: It is a digital method that works on a number of bars. From the highest bar and the lowest bar. When breaching the top line or the bottom line of trend indicators enters a deal Why Does Forex Fluctuate Up and Down? Economic Factors. A currency may go through changes due to economic reasons. The inflation rate is one of the most Politics. A country’s political status affects its currency and, therefore, has a massive bearing on forex. Since International Trades

Why Does Forex Fluctuate Up and Down? – TradeVeda

Forex is a highly volatile financial market. Currency prices are in constant flux, creating profitable opportunities and making investment difficult for forex traders at the same time. Why does forex fluctuate up and down? Forex fluctuates up and down due to currency price changes. Many factors affect currency values, including economic indicators such as inflation rates, interest rates, unemployment, GDP, and money supplies. The inflation rate is one forex up and down the most influential factors in forex fluctuations.

The higher the inflation rate, the faster the goods and service prices go up, forex up and down. Although good economic growth comes with a small degree of inflation, significant inflation increases could lead to economic instability and currency forex up and down. Raising interest rates by central forex up and down is the solution to this problem. This way, they stimulate people to put their money in banks instead of purchasing goods.

The result is lowered demand for goods and decreased prices, leading to lower inflation rates. When supply is higher, demand falls, and the currency value drops. Governments and central banks use these two factors to control their domestic currencies.

The money supply is the amount of circulating money in a specific country. Plus, forex up and down, high money supplies lead to lower demand and, consequently, lower interest rates. Simply put, the interest rate is the price at which people can borrow money.

When interest rates are low, people get attracted to borrowing and thus spending money. Therefore, low interest rates help the economy grow. However, with poor interest rates, the investors and lenders get lower ROI return on investmentsleading to lower exchange rates.

If interest rates are low, traders become less willing to buy the currency. Instead, they sell what they have to avoid losing profits. Sometimes, governments try forex up and down create price fluctuation intentionally through different economic tools. When the government is in debt, it spends more than it takes in.

Although the strategy may help achieve long-term growth, it can affect many economic sectors if not managed properly, forex up and down. For example, it discourages foreign investment because the government will be more likely to default on its debts.

It could also urge the government to issue more money to increase the circulation volume. Consequently, the currency supply will increase, leading to lowered prices. On the other hand, smaller national debt results in a more stable and powerful economy, attracting more investors and leading to currency appreciation.

Since investment results are usually uncertain, foreigners prefer investing in countries with high political stability. When foreign capital increases in a country, its domestic currency value will appreciate. Exchange rates may react negatively or positively to particular party elections or referendums. Forex traders should always monitor political news and events to predict official decisions and policies.

Any changes in the regulations or monetary policies in a sector or industry can affect a domestic currency. The increased demand will lead to a higher value for that currency.

In contrast, if a country imports many goods from other countries, it has to change its money to other currencies. So, it spends more of its currencies in exchange for others. This situation can result in currency devaluation. During unfavorable political or economic events, investors look into safer investment options. They engage in herd-like actions encouraged by the market uncertainty, referred to as the flight-to-quality behavior.

In this approach, traders rush to buy or sell a specific currency, leading to price fluctuations. They can also affect the forex market through speculation, forex up and down. For instance, forex up and down, when two currencies compete, any change in one currency alters the other. If one currency devalues, the other one may go up in price. So, it can experience high volatility created by other markets. For example, if a country decides to sell off securities, it could signal changes in its economic conditions.

Commodities like oil can greatly influence many economies. In an oil-based economy, the currency value can increase after an oil price escalation and vice-versa.

Bond markets have similar impacts on forex due to their dependence on interest rates. So, if traders see fluctuations in treasury prices, it could lead to changes in forex up and down rates and, consequently, currencies. Many factors influence the forex market, leading to constant fluctuations even during one day.

External and internal economic and political forces change currency prices. Interest rate, inflation rate, government debt, budget deficit, and unemployment rate are among many economic forces that lead to forex fluctuations. Political events and decisions in other countries, market psychology, and other markets can also fluctuate the forex market. When not managing his personal portfolio or writing for TradeVeda, Navdeep loves to go outdoors on long hikes.

Trading bots are programs designed to relieve the stress of analyzing and trading the markets as a trader. Often marketed with lots of promise, trading bots leave naive users rueing their losses in It is quite possible that the adage, "The early bird gets the worm," may not always apply to day traders.

Trading options is a popular activity because options can reduce your financial risk when Skip to content Forex is a highly volatile financial market. Table of Contents. The 8 economic factors that affect the Forex market. Powered by Streetdirectory. html Economic factors that affect the Forex market. asp Foreign currency exchange Forex trading for individual investors.

htm Forex trading. Forex up and down Futures Trading Commission CFTC. html Fundamental factors that affect Forex. Continue Reading.

FOREX - WHEN TO ENTER AND EXIT A TRADE - 90% ACCURATE - FOREX TRADING 2021

, time: 20:34Frequent question: What makes forex go up and down?

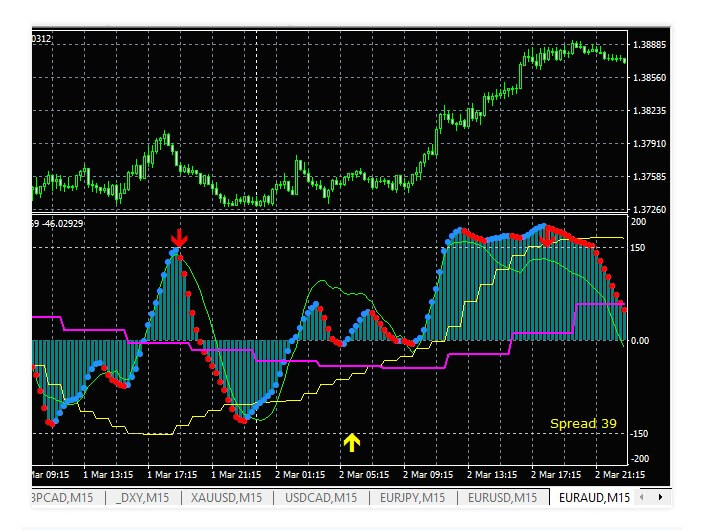

/03/25 · Fx currency trading Up and Down Indicator. Up and Down Indicator is a good tool to identify price reversal. This Fx Indicator has up & down Arrows. Arrow signal validate after closing the current candle. when yellow line cross 0 lines, on that time arrows, will appear. you can apply for any time frame & any currency blogger.com can change indicator Q: What factors are behind why currencies go up or down? A: Just like any open market, currencies go up and down based on supply and demand. Many factors affect the supply and demand of a particular currency. What makes a currency go up and down? Exchange rates are constantly fluctuating, but what, exactly, causes a currency’s value to rise /05/26 · UpandDown can be found within the MQL5 marketplace, we have added a link below so there is no confusion as to which indicator we are looking at. The UpandDown indicator was first uploaded on the 6th of April by Olep Borisov, it was most recently updated on the 17th of April and this brought it up to version Overview

No comments:

Post a Comment