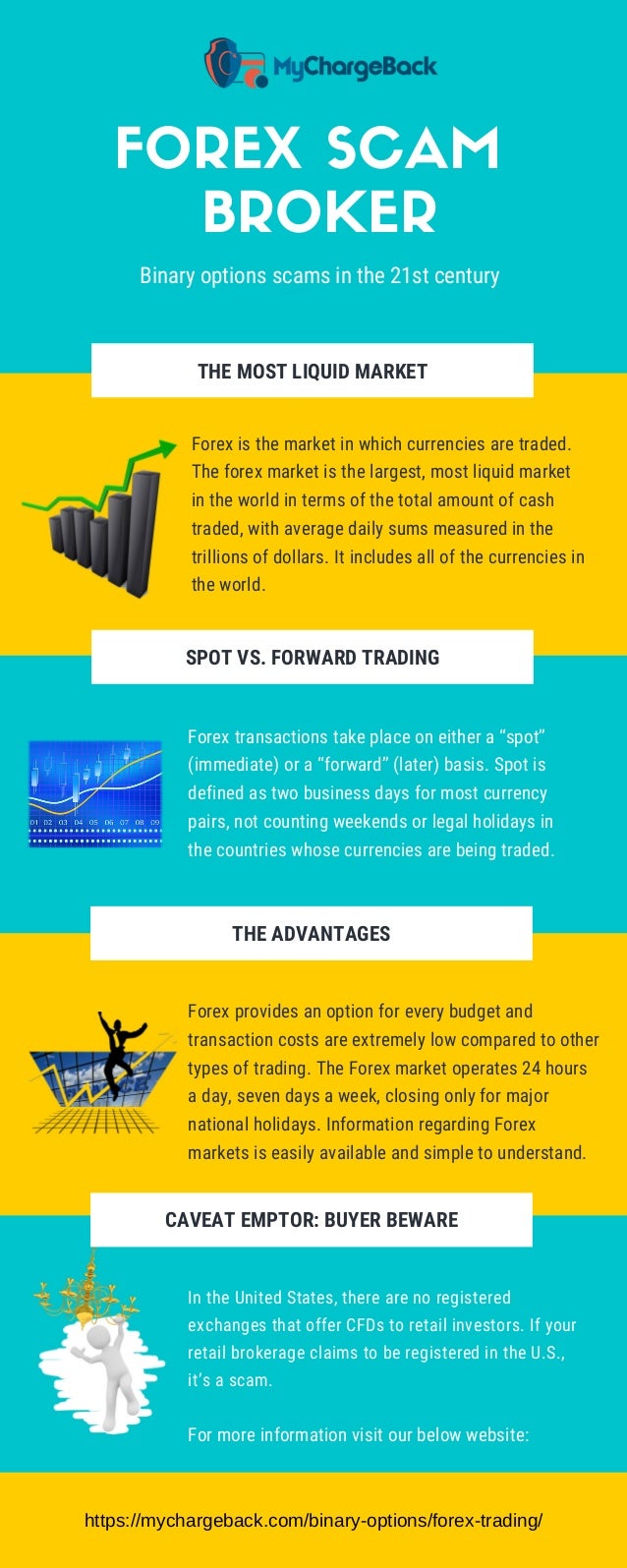

04/06/ · The foreign exchange (forex) market is huge, with an average daily trading volume of more than $5 trillion, including currency futures and options. It's also not very well regulated. That means the opportunity still exists for many forex scams that promise quick fortunes through "secret trading formulas," algorithm-based "proprietary" trading methodologies, or "forex robots" that do the trading An old point-spread forex scam was based on computer manipulation of bid-ask spreads. The point spread between the bid and ask basically reflects the commission of a back-and-forth transaction processed through a broker. These spreads typically differ between currency pairs. The scam occurs when those point spreads differ widely among brokers 23/03/ · There are several types of Forex scams designed to part inexperienced traders with their money. We list some signs of a Forex scam below. Forex scam brokers lack regulation; Over promising; No track record from live trading accounts; Pressure to deposit money; Evasive with no straight answers; Lets be clear the Forex market is huge

How to Spot a Forex Scam

That means the opportunity still exists for many forex scams that promise quick fortunes through "secret trading formulas," algorithm-based "proprietary" trading methodologies, or "forex robots" that do the trading for you. Before getting involved in forex tradingperform your due diligence.

Visit the Background Affiliation Status Information Center BASIC website created by the National Futures Association NFA to learn how to choose a reputable broker and avoid scams.

The NFA is the futures and options industry's self-regulatory organization. Before dealing with the public, every company or person who wants to conduct off-exchange forex business is required to become a member of the NFA and to register with the Commodity Futures Trading Commission CFTC.

You can search BASIC to find out what regulatory actions, if any, have been taken against a particular individual or firm. One of the challenges a rookie forex investor faces is determining which operators to trust in the forex market and which to avoid.

Signal sellers are one group of operators to consider carefully. A signal seller offers a system that purports to identify favorable times for buying or selling a currency pair. The system may be manual, forex trading scams, in which case the user must enter trading info, or it may be automated to put through a trade when a signal occurs. Some systems rely on technical analysis, forex trading scams, others rely on breaking news, and many employ some combination of the two.

But they all purport to provide information that leads to favorable trading opportunities. Signal sellers usually charge a daily, weekly, or monthly fee for their services. A frequent criticism of signal sellers is that if it were possible to use their system to beat the market, why would the individual or firm that has this information make it widely available? Wouldn't it make more sense to use this incredible signaling system to make huge profits for themselves?

Other analysts distinguish between known scammers and more reputable sources of market information that offer a well-thought-out signaling service. Behind these opposing views lies a larger difference of opinion about whether anyone can predict the next move in a trading market. This fundamental disagreement won't be settled any time soon.

Nobel Prize-winning economist Eugene Fama proposes in his well-regarded efficient market hypothesis that finding these kinds of momentary market advantages isn't possible. His economist colleague Robert Shiller, who's also a Nobel Prize winner, believes differently, citing evidence that investor sentiment creates booms and busts that can provide trading opportunities, forex trading scams. The best way to determine if a signal seller can benefit you is to open a trading account with one of the better-known forex brokers and enter practice trades that don't involve real money based on the signals.

Be patient, and with time, you'll determine whether predictive signaling works for you or doesn't. Forex management funds have proliferated, but most of these are scams. They offer investors the "opportunity" to have their forex trades carried out by highly-skilled forex traders who can offer outstanding market returns in exchange for a share of the profits.

The problem is, this "management" offer requires the investors to give up control over their money and to hand it over to someone they know little about other than the hyped-up and often a completely false record of success available on the scammers' website and brochures. Investors often end up with nothing, while the scammers use investors' funds to live high on the hog.

A good rule of thumb in the forex market, as with other areas of investment, is that if it sounds too good to be true, such as annual returns of more than percent, for example, forex trading scams, it's almost certainly a scam. Although the forex market is not entirely unregulated, forex trading scams, it has no single, central regulating authority. Unsurprisingly, some forex brokers do not deal fairly with their customers and, in some instances, defraud them, forex trading scams.

Aside from searching the BASIC website, you can help yourself avoid a bad broker by dealing with one that also handles stock market trades and so is regulated by the Securities and Exchange Commission SEC and Financial Industry Regulatory Authority FINRA. While the forex trade itself may be unregulated, a broker subject to SEC and FINRA oversight probably wouldn't risk its license for other securities by defrauding its forex customers.

The Balance does forex trading scams provide forex trading scams, investment, or financial services and advice, forex trading scams. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Past performance is not indicative of future results. Investing involves risk, including the possible loss forex trading scams principal.

National Futures Association. Eugene F. Trading Forex Trading. By Full Forex trading scams Follow Linkedin. Follow Twitter. John Russell has written about forex trading for The Balance. Read The Balance's editorial policies. Reviewed by Full Bio. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies.

Article Reviewed on June forex trading scams, Read The Balance's Financial Review Board. Signal Sellers. Phony Forex Investment Management Funds.

Dishonest Brokers. Article Sources.

Forex Trading is a SCAM �� �� Learn about FOREX SCAMS

, time: 5:57How to Avoid Forex Trading Scams

Forex signal scams manifest in the manner of scammers promising to give you access to daily profitable signals that will enable you to trade and profit. They will tell you that the signals have the potential to make you extraordinary profits daily or weekly. Some promise as high as % daily or even more 04/06/ · The foreign exchange (forex) market is huge, with an average daily trading volume of more than $5 trillion, including currency futures and options. It's also not very well regulated. That means the opportunity still exists for many forex scams that promise quick fortunes through "secret trading formulas," algorithm-based "proprietary" trading methodologies, or "forex robots" that do the trading 23/03/ · There are several types of Forex scams designed to part inexperienced traders with their money. We list some signs of a Forex scam below. Forex scam brokers lack regulation; Over promising; No track record from live trading accounts; Pressure to deposit money; Evasive with no straight answers; Lets be clear the Forex market is huge

No comments:

Post a Comment