In basic terms, forex refers to the purchase of one currency against another. Plus offers CFD trading on over 70* different currency pairs. In the world of forex, there are 3 primary markets Plus; IC Markets; Forex; eToro; Admiral Markets; High-Risk Warning: Spot Forex, CFDs, Futures, Options and Cryptocurrency exchanging are rewarding yet accompany high hazard. All these monetary instruments are twofold edged blades. They can give you attractive rewards however at the expense of high dangers. Subsequently, this kind of venture isn’t appropriate for all financial specialists. Never Plus Forex Leverage. Forex (currency trading) is the most popular instrument to be traded worldwide, and Plus is no exception. Over 70+ forex pairs can be traded with the main base currencies of the top pairing, including the: Australian Dollar (AUD) British Pound (GBP) Euro (EUR) United States Dollar (USD) Japanese Yen (JPY) Swiss Franc (CHF) New Zealand Dollar (NZD)

Plus Leverage On Forex, Crypto, CFDs + More -

Regulated By: ASIC, CySEC, FCA, FSB, ISA, MAS. Foundation Year : Headquarters : Building 25, MATAM, Haifa, Israel. Plus was founded in and is the main sponsor of football club Atlético Madrid. The Plus trading platform is offered by Plus UK Forex plus 500 which is authorised and regulated by the UK Financial Conduct Authority and is also a subsidiary of Plus Ltd which forex plus 500 a publicly-traded company listed on the London Stock Exchange.

Demo : Open Demo Account. Max Leverage : Publicly Traded : Yes. Deposit Options : Credit Card, Moneybookers, PayPal, Skrill, forex plus 500, Wire Transfer. Withdrawal Options : Credit Card, forex plus 500, Moneybookers, PayPal, Skrill, Wire Transfer. Tradable Assets : Currencies, Commodities, Indices, Stocks, Crypto, Futures, Options. Trading Platforms : Plus Commission on Trades forex plus 500 No. Fixed spreads : Yes. Trading Desk Type : No dealing desk.

OS Compatibility : Desktop platform Windowsforex plus 500, Desktop platform Macforex plus 500, Web platform. Mobile trading : Android, iOS. Accepts US Clients : No. Plus is regulated around the world by some of the major financial regulators. For example, PlusUK Ltd is authorised and regulated by the UK Financial Conduct Authority, forex plus 500, as shown below:.

PlusSEY Ltd is authorised and regulated by the Seychelles Financial Services Authority Licence No. PlusAU Pty Ltd ACNlicensed by: ASIC in Australia, AFSLFMA in New Zealand, FSP ; Authorised Financial Services Provider in South Africa, FSP You do not own or have any rights to the underlying assets.

All subsidiaries offer further client protection by holding client money in segregated accounts and by providing a negative balance protection policy which is a regulatory requirement for all European brokers and are therefore obligated to provide it. Plus offers users the ability to trade on a wide variety of different asset classes. This includes access to more than 2, leveraged financial CFD instruments covering Forex, Commodities, Indices, Shares, Options and Cryptocurrencies. Users can access a wide range of exotic currencies, country and sector indices such as the Lithium and Battery Index, Cannabis Stock Index and others and a wide range of shares from the following countries: UK, USA, Japan, Singapore, South Africa and most major European countries.

Below is a list of just some of the available markets for trading:. Trading costs such as spreads and overnight funding swap rates vary depending on the instrument being traded and are covered further down this review.

The broker also offers Islamic swap-free accounts and access to an unlimited free demo trading account. Opening an account with Plus is quick and easy, forex plus 500. You will then be prompted with the option to choose between Real Money mode or Demo mode on the Plus platform. This will then log you into the trading platform. To use a real money account users will need to go through a verification process which includes proof of identity and proof of address.

Documents can be forex plus 500 into the trading platform to complete the real money application process. With Plus, users can also apply for a Plus Professional Account which is for those who meet the regulatory threshold to go from a Retail Client Plus Standard Account to an Elective Professional Client Plus Professional Account.

While some protections will remain such as client money protection, negative balance protection and others, Professional Clients will not be able to access the Financial Ombudsman Service. Another core difference between the standard retail and professional account is the maximum leverage offered. For standard retail accounts, it is and for professional accounts, it is but varies for different asset classes.

Plus does not accept clients from the USA, Canada, Cuba, Iran, Yemen, North Korea, Belgium, Iraq, Syria and Nigeria. Plus offers swift and secure deposit and withdrawal methods which are fee-free, forex plus 500.

Forex plus 500, users may be charged if exceeding the maximum number of monthly withdrawals, as well as for international credit card transactions or bank wire transactions using a currency that is not supported.

Users can deposit and withdraw funds using bank wire transfers, debit and credit cards and e-wallets such as PayPal and Skrill. Funds can be managed directly from the Plus trading platform. The platform comes with different features and in 32 languages and is available via Web browser. The Plus trading platform is feature-rich with a simple and intuitive user interface which offers customisable and easy to use charts for technical analysis.

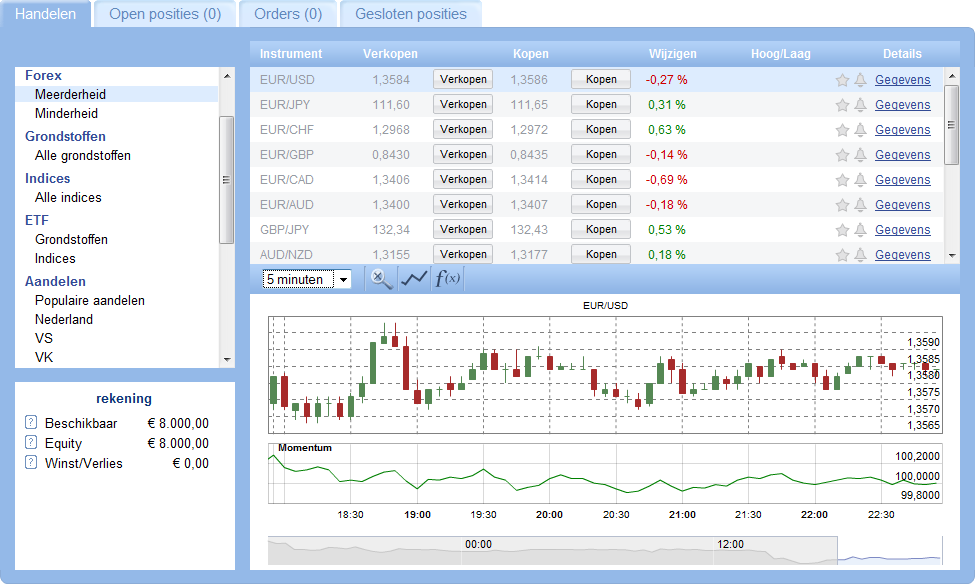

The platform also offers a variety of other features which include:. Below is a screenshot of the trading platform which is covered in more detail in the video review. Plus offers users the ability to trade on its own proprietary, feature-rich mobile trading app for Android and iOS.

Below is a screenshot of the Plus mobile trading app which is covered in more detail in the video review. Plus offers additional trading features which include the use of guaranteed stop orders. This helps traders limit risk to an absolute limit of potential loss, forex plus 500.

The cost of this extra feature is built into the spread which means it must be at a certain predefined distance away from the current trading price of an instrument. Users can also access forex plus 500 stop orders and close at profit or close at loss orders. The Plus platform also allows users to access real-time email, SMS and push notification alerts based on:.

Plus offers commission-free trading with tight spreads on a variety of different asset classes. Additional fees include:. This area also provides details on the overnight funding charge for buying and selling, as shown below:. Plus offers dedicated, multilingual support in 16 different languages 24 hours a day, 7 days a week through Live Chat, WhatsApp and Email.

An FAQ section forex plus 500 also offered which covers the frequently asked questions for deposits, opening an account, verification, withdrawals and more. After logging into the Live Chat we were greeted by an agent instantly who answered our question within seconds, providing a very fast customer service response, as shown below:.

Plus does not offer any trader research tools or resources apart from an Economic Calendar which can be found on the website and in the trading platform, as shown below:. From our observations, Plus offers a simple and transparent trading offering. While trader research and educational resources are limited the Plus trading platform has a simple and intuitive user interface and is simple to use.

Elected professional clients are forex plus 500 maximum leverage ofbut both retail and professional traders can enjoy commission-free trading with tight spreads and a negative balance protection policy which is a regulatory requirement for all European brokers and are therefore obligated to provide it.

Plus makes money mainly through spreads, with additional fees from overnight funding charges and currency conversion fees. Funds can be deposited into a trading account via credit and debit cards, bank wire transfer, PayPal and Skrill. Withdrawals can be made from Plus via credit and debit cards, bank wire transfer, PayPal and Skrill. The maximum leverage offered by Plus is for clients categorised as Professional or for retail clients.

An account can be opened at the click of a button on the Plus website and can be done in just a few steps. support is great, and withdrawal hassle free. And I love the mobile platform. Excellent broker with the best mobile platform ever. Uso anche questo broker mi trovo molto bene società seria e puntuale. بسيط ومنظم وواجهة عملية سهولة تحويل وايداع وسهولة بالسحب عن تجربة أفضل من كل البرامج بعد تجربة مريرة مع أشهر البرامج وخصوصا للمبتدأين بالتدول من جديد.

I started trading with P from March I have had losses and successful withdrawals. Both their deposit and withdrawals are seamless. I just loove them! Mini Account : No. Premium Account : Forex plus 500. Demo Account : Yes. Islamic Account : Yes. Segregated Account : Yes, forex plus 500.

Managed Account : No. Institutional Account : No. Beginners : No. Professionals : Yes. Scalping : No, forex plus 500. Day Trading : Yes. Weekly Trading : Yes.

Swing Trading : Yes. Here at FXEmpire, we would like to welcome you to the Broker awards. Plus The settlement came after months of discussions between Plus and FSMA. According to the FSMA, Plus offered CFDs on Belgian territory without a regulatory. English English Italiano Dansk Dutch Français Deutsch Eλληνικά العربية Norsk Português Русский Español Svenska Türkçe 日本語. Markets Crypto News Forecasts Education FXTM Academy Trade Now Brokers Tools Economic Calendar Macro Data.

Crypto Hub.

Trading: The right way to trade the forex (2021)

, time: 11:59Plus | blogger.com | Leader worldwide!

15/05/ · Plus is, without any doubt, one of the most famous CFD brokers in the world. They offer loads of interesting features and in this article we will analyze one of them. Our topic today will be the Plus demo account Forex signals are not offered by Plus Plus sends market event notifications. These are free-of-charge and are available across multiple asset classes; rather than making a suggestion to a trader about when to execute or exit a trade, Plus alerts are merely price alerts reflecting current market events. Setting automatic orders. When trading currency pairs, you’ll want to take into account the exchange 26/03/ · The Plus group also has subsidiaries operating and duly regulated in Cyprus and Australia, Israel, Singapore, South Africa and New Zealand. Currently Plus offers its portfolio of over instruments. Contracts for Differences allow customers to profit from a stock, index, ETF, forex or commodity position without the need to actually

No comments:

Post a Comment