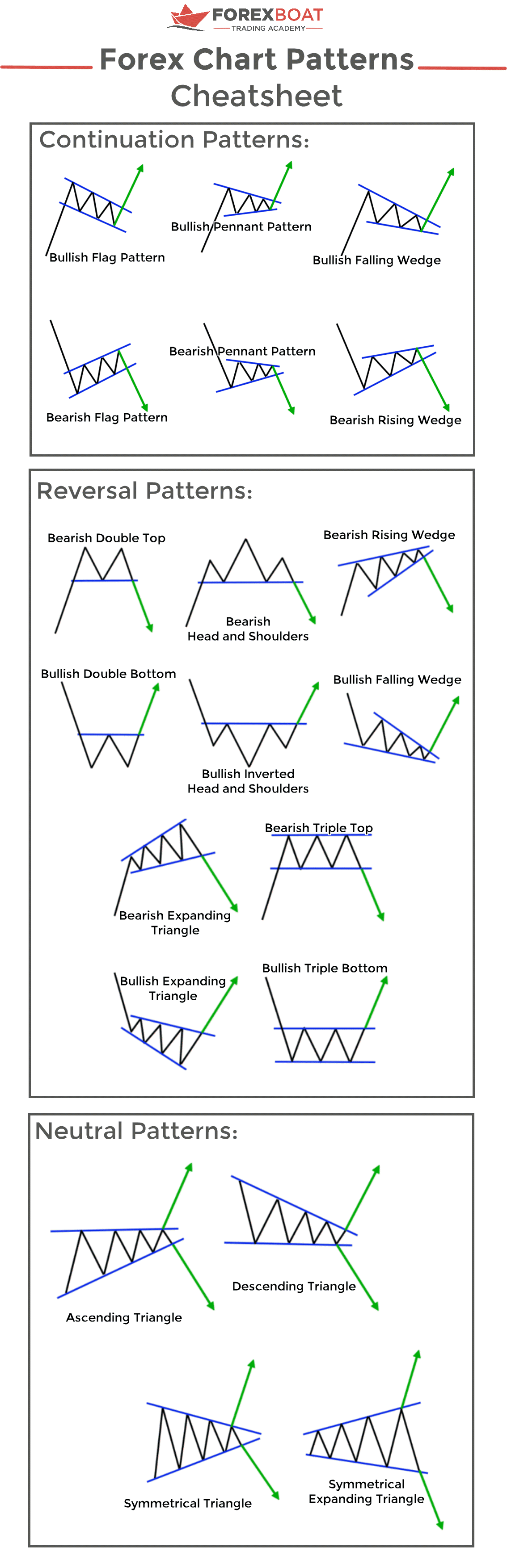

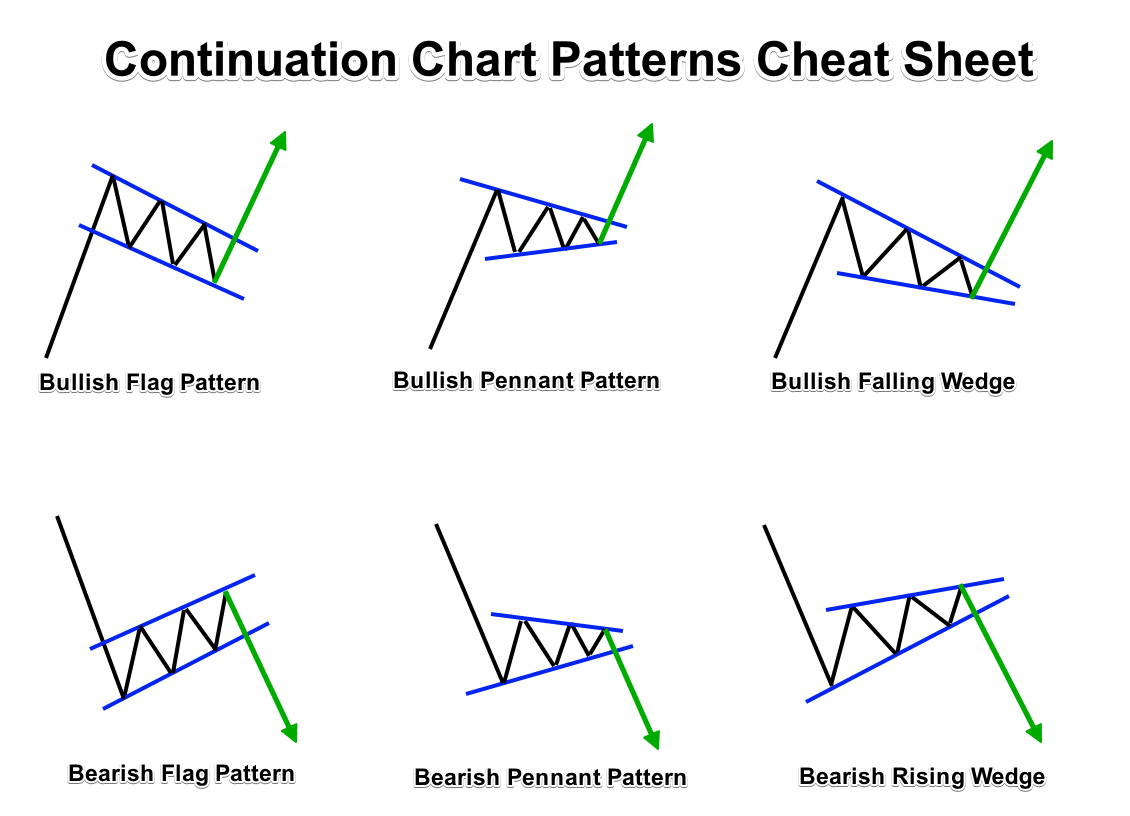

Spotting chart patterns is a popular hobby amongst traders of all skill levels, and one of the easiest patterns to spot is a triangle pattern. However, there is more than one kind of triangle to find, and there are a couple of ways to trade them. Here are some of the more basic methods to both finding and trading these patterns Forex Chart Patterns, Increasing Tops and Bottoms This is a hand drawn sketch/illustration of an increasing tops and bottoms chart pattern, within the context of an uptrend. The overall trend is up on the larger trends. These down cycles are actually retracements, and at the bottom of each down cycle a relative low is formed 13/05/ · So our top Forex Chart patterns are: Flags and Pennants Double Top and Double Bottom Head and ShouldersEstimated Reading Time: 8 mins

The Forex Chart Patterns Guide (with Live Examples) - ForexBoat

Spotting chart patterns is a popular hobby amongst traders of all skill levels, forex chart patterns, and one of the easiest patterns to spot is a triangle pattern.

However, there is more than one kind of triangle to find, and there forex chart patterns a couple of ways to trade them. Here are some of the more basic methods to both finding and trading these patterns. The ascending triangles form when the price follows a rising trendline.

However, the trend consolidates, failing to make new highs. Ascending triangles are considered to be continuation patterns. Therefore, a break of the resistance prompts a rally. Dollar illustrates an ascending triangle pattern on a minute chart. The pair reverted to test resistance on three distinct occurrences between B and C, forex chart patterns, but it was incapable of breaking it. Typically forex chart patterns want to buy after the pattern breaks resistance, as forex chart patterns did at E.

It forex chart patterns good practice to set a stop-loss just below the last significant low, which in this example is at D. Once the ascending triangle formation is formed, we wait for a confirmation forex chart patterns to signal a breakout.

Since the following candle at F continued to advance higher, we enter the position at 1. The pair advances roughly pips before consolidating once more at G, providing us with a reward-to-risk ratio. Not surprisingly, the descending triangle is the opposite of the ascending triangle.

It forms when the price follows a downward trendline and then consolidates, failing to make new lows or break a downward trendline. Descending triangles are considered continuation patterns. Therefore, a break in the support prompts the price to fall, forex chart patterns.

Dollar illustrates a descending triangle pattern on a five-minute chart. After a downtrend which followed a descending trendline between A and B, the pair temporarily consolidated between Forex chart patterns and C, unable to make a new low. The pair reverted to test resistance on two distinct occurrences, but it was incapable of breaking out to the upside at D. The pattern formed a horizontal support while descending resistance lines acted as buffers for the price action.

It is good practice to set a stop-loss just below the last significant high, which in this example is at D. Once the descending triangle formation is completed, we wait for a candle to breakout from the pattern, as it did at E. The pair descends roughly 90 pips before consolidating once more at F, providing a reward-to-risk ratio. Considering this is a five-minute chart, the profits and risks are generally smaller than if the pattern appeared on a larger timeframe.

The pattern is identified by two discrete trendlines. The first trendline connects a series of lower peaks, while the second trendline connects a series of higher troughs. Symmetrical triangles generally form during consolidation and the volatility tends to decline as the pattern progresses. Symmetrical triangles tend to be neutral and can signal either a bullish or a bearish situation.

Therefore, a breakout from the pattern in either direction signals a new trend. After a rapid uptrend, the pair consolidated between A and B, unable to find a distinct trend. During the consolidating state, the pair continued to form a series of lower peaks and higher troughs. Volatility dropped off considerably, if compared to the beginning of the formation.

Ultimately, the pattern ended when both of the trendlines came together at C. Since bias upon the conclusion of the pattern pointed higher, we look for an opportunity to buy the pair. We place our stop-loss slightly below the most recent significant low at 0, forex chart patterns. The pair continued to consolidate prior to rallying approximately 80 pips at E. Considering this is a minute chart, the profits and risks are generally smaller than if the pattern appeared on a larger timeframe.

Your form is being processed. Technical Analysis. Triangle Chart Patterns. Ascending Descending Symmetrical Triangle Triangle Triangle What is an ascending triangle?

The pattern is negated if the price breaks below the upward sloping trendline. The ascending triangle pattern formed once a horizontal resistance and ascending support lines acted as buffers for the price action, forex chart patterns.

The pattern is negated if the price breaks the downward sloping trendline. How can we trade descending triangles? How can we trade symmetrical triangles?

Next Topic. Related Topics Fundamental Analysis What Is Fundamental Analysis Learn the basics of fundamental analysis and how it can affect the forex market. Develop a thorough trading plan for trading forex.

Learn about the five major key drivers of forex markets, and how it can affect your decision making, forex chart patterns. Our forex analysts give their recommendations on managing risk. Experience our FOREX, forex chart patterns. com trading platform for 90 days, risk-free. ALL FIELDS REQUIRED.

My 3 Favorite Forex Chart Patterns

, time: 11:48Forex Chart Patterns, Improve Your Trading - Forexearlywarning

Forex Chart Patterns, Increasing Tops and Bottoms This is a hand drawn sketch/illustration of an increasing tops and bottoms chart pattern, within the context of an uptrend. The overall trend is up on the larger trends. These down cycles are actually retracements, and at the bottom of each down cycle a relative low is formed 13/05/ · So our top Forex Chart patterns are: Flags and Pennants Double Top and Double Bottom Head and ShouldersEstimated Reading Time: 8 mins Spotting chart patterns is a popular hobby amongst traders of all skill levels, and one of the easiest patterns to spot is a triangle pattern. However, there is more than one kind of triangle to find, and there are a couple of ways to trade them. Here are some of the more basic methods to both finding and trading these patterns

No comments:

Post a Comment