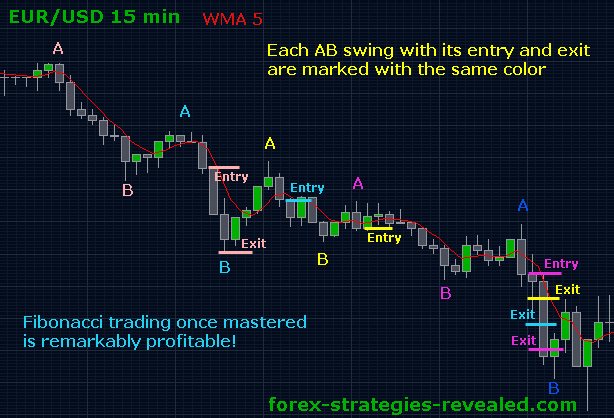

This is given by the retracement level the first b-wave makes into the territory of the previous a-wave. In a flat, the b-wave should end beyond the % retracement level, while in a zigzag, the b-wave should end before that level. Once again, the golden ratio comes in handy in identifying the nature of the complex correction 29 rows · Is a leading provider of online foreign exchange (FX) trading, CFD trading and related Point B is a significant low; In the move from A to B there can be no highs above point A, and no lows below B; If AB, then find BC; Point C must be lower than point A ; In the move from B up to C there can be no lows below point B, and no highs above point C; Point C will ideally be % or % of AB

ABCD Pattern | blogger.com

In the previous article, we expanded the ideas of the triangle pattern; in particular, we talked about the contracting triangle and its variations. In this last part dedicated to the triangle pattern, we will review the forex b complex triangle. Non-limiting triangles do not differ much from limiting triangles. Both types of triangles must meet the minimum construction requirements.

However, they will have the following characteristics:. In the case of the non-limiting triangle, the trend lines are not convergent but divergent. Congestion occurs just at or near the apex of the convergence lines. There must be a post-thrust correction that must return to the apex area.

If the triangle met any of these three conditions, then the triangle will be said to be of the non-limiting type. The distance of the thrust outside the limits of the non-limiting triangle does not have a specific restriction. However, it can reach the length equivalent to the longest segment of the forex b complex. Likewise, forex b complex, once reached this extension, there is a possibility that the price will continue in the original direction of the thrust.

Expanding triangles are very frequent in complex corrections, forex b complex. It is characterized because as it progresses in forex b complex formation, forex b complex, each segment, or the majority, is larger than the previous one.

The rules that characterize the expanding triangles are forex b complex below:. The following figure shows the three most common types of expanding triangles, of which the irregular is the most likely to appear in the real market.

In expanding triangles also exists limiting and non-limiting triangles. However, in this type of formations, there is no post-triangular variation between one and the forex b complex. Its main characteristics are described below.

An expansive limiting triangle usually appears in wave B, particularly in irregular failures or in flat wave formations with failure in wave C.

The thrust outside the triangle is a minimum of approximately This variation rarely appears in the real market. However, this does not mean that there is no possibility of it showing up in real markets. Waves B, C, D, and E y must each exceed the final point of the previous wave.

There is a possibility that wave E will exceed the guideline of waves A-C. This variation is more common, and its characteristics are as follows:. Wave B is smaller than Wave A, while the rest of the waves maintain their increasing characteristics. The longer the duration of the pattern, the higher the chance that the guideline will tilt up or down.

This expanding triangle has a bias due, on the one hand, because wave B is longer than wave A, and on the other hand, because wave C is the shortest. These types of triangles tend to appear in complex corrective formations, forex b complex, for example, in the first or last stage of a complex sequence. In this sense, in a complex corrective structure, the thrust will generate a forex b complex X. With this article, we have ended the standard corrective patterns defined by the Elliott wave theory.

As we have seen in previous examples, expansive triangles also usually appear on waves 4 and B. However, this does not mean that they cannot appear on wave 2. In the next educational article, forex b complex, we will see the process of validating impulsive structures, forex b complex. Save my name, email, and website in this browser for the next time I comment. About Us Advertise With Us Contact Us.

Forex Academy. Home Forex Technical Analysis Forex Elliott Wave Analyzing the Triangle Pattern — Intermediate Level Part 3. RELATED ARTICLES MORE FROM AUTHOR.

USDJPY: Be Ready for this Flag Pattern Breakout. USDCHF: Examine These Three Charts Before Taking any Trade. Three Things you Ought to Know Before Buying EURUSD. Forex b complex A REPLY Cancel reply. Please enter your comment! Please enter your name here. You have entered an incorrect email address! Popular Articles.

Forex Chart Patterns Might Be an Illusion 4 September, Chart Patterns: The Head And Shoulders Pattern 16 January, How to Make Real Money with a Forex Demo Account 27 August, Academy forex b complex a free news and research website, offering educational information to those who are interested in Forex trading. EVEN MORE NEWS. Monster Harmonic Indicator Review 30 April, How to Correctly Use an Economic Calendar 30 April, Royal Trade FX Review 30 April, POPULAR CATEGORY Forex Market Analysis Forex Service Review Forex Brokers Crypto Market Analysis Forex Signals Forex Cryptocurrencies Academy - ALL RIGHTS RESERVED.

3 Best Forex Brokers for 2020

, time: 9:25Analyzing the Triangle Pattern – Intermediate Level Part 3 | Forex Academy

Trading currencies can be risky and complex. The interbank market has varying degrees of regulation, and forex instruments are not standardized This website is owned and operated by Forex Bank Pro. Trust Company Complex British Virgin Islands Forex Bank Pro is authorized to provide the financial Services as offered through this website under Regularity Laws of British Virgin Islands registration # This is given by the retracement level the first b-wave makes into the territory of the previous a-wave. In a flat, the b-wave should end beyond the % retracement level, while in a zigzag, the b-wave should end before that level. Once again, the golden ratio comes in handy in identifying the nature of the complex correction

No comments:

Post a Comment