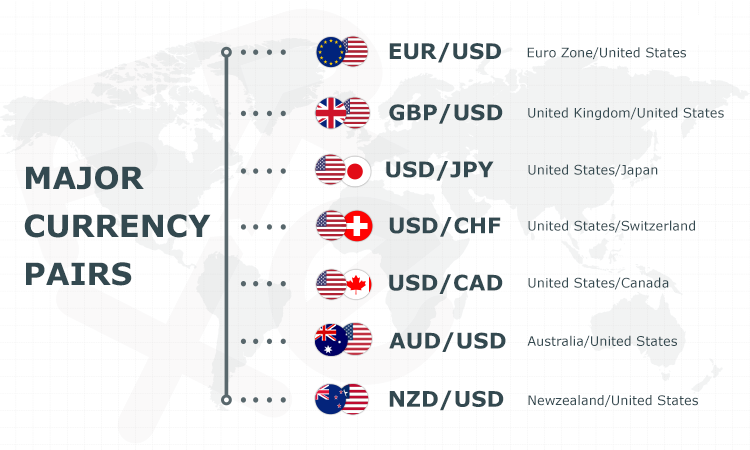

Here are the 7 major currency pairs that make up for most of the trading activity in forex markets: EUR/USD – Fiber Nicknamed “Fiber”, the EUR/USD (euro/US dollar) is the world’s most heavily traded currency pair accounting for 29% of all forex transactions in Analysis of the Seven (7) Forex Majors. What are the Forex Majors? The Forex Majors are the most liquid currency pairs that contain the US Dollar either on the base side or on the quote side. The majors include seven (7) pairs. 1. EUR/USD (Euro / United States Dollar) 2. USD/JPY (United States Dollar /Japanese Yen) 3 Typically referred to as “The Majors”, these seven currency pairs make up almost 80% of total daily trading volume*. As you’ll see in the table below, the major currency pairs all include the U.S. Dollar (USD)

What are the 7 Major Currency Pairs? - Orbex Forex Trading Blog

All 28 pairs can trend up and down for days, weeks or months. Similarly, all 28 pairs, including the forex major pairs, can become choppy and difficult to trade, or oscillate in wide, trade-able ranges. As a forex trader we are looking for trending pairs that we can enter a trade with, then ride the trend up or down for long cycles, forex 7 major pairs, but we can also do short term trades for forex 7 major pairs or day trading profits using our tools and indicators.

The only thing that matters is the strength and quality of the trends and trading signals that you use with our trading system. You should not have any bias towards any major pair or non major pair. Always trade the best opportunity that the market trends and signals are presented to you of the 28 pairs we have at our disposal every day. If the market is choppy or the signals are weak you can also choose not to trade. Like this article? Come join us for our free weekly forex webinars, forex 7 major pairs.

Tweet Share in Tumblr Reddit, forex 7 major pairs. Home About Us Login Subscribe Blog Forex 7 major pairs Tips Contact Us Education 35 Lessons Videos Webinars Sitemap. Forex Major Pairs, Currency Pair Characteristics. We trade 8 currencies and a total of 28 major forex pairs with the Forexearlywarning trading system.

Since our trading system accommodates so many pairs, it takes some traders a while to get used to trading this way. We will review the characteristics and traits of all 28 pairs along with a comparison of these characteristics, forex 7 major pairs.

Charcteristics like volatility, forex 7 major pairs, spreads and when these pairs move, etc. will be investigated. A forex major pair is a currency pair with the USD on the left or right side of the pair. We trade a total of 7 major pairs with the Forexearlywarning trading system. With the Forexearlywarning system we trade eight currencies. These are the US Dollar, Canadian Dollar, Euro, British Pound, Swiss Franc, Japanese Yen, Australian Dollar and the New Zealand Dollar.

Out of these 8 currencies, the three most actively traded and most liquid currencies are the USD, EUR, and JPY. Currencies like the CAD, NZD and AUD are commodity based currencies are correlated to the movements in the prices of oil and gold. The other currencies are more reserve based currencies, which are held in large quantities by governments and banks. These eight currencies can be combined into 28 pairs. These 28 combinations include 7 major pairs and 21 exotic pairs. All 28 pairs can move in the main trading session, including all of the forex major pairs.

A few times per month, the AUD and NZD based forex 7 major pairs can move quite a bit in the Asian session after some related economic news drivers. These movements can carry forward to the main trading session and give sizable movements, but this only happens a few times per month.

Be sure to check our complete article about trading in the Asian session and also about the limitations. Also, the JPY pairs can move in the Asian session when they are in consistent up trends or downtrends on all pairs.

If you check the economic calendar for the main trading session you can see how the European based pairs can move first followed by the USD and CAD pairs as the trading day progresses.

Just to be clear, all 28 pairs can move at any time the forex forex 7 major pairs is open, but forex 7 major pairs majority of the movements follow the guidelines forex 7 major pairs here. Currency pair characteristics for causing price movement are pretty simple, forex 7 major pairs. All pairs, including the forex major pairs, move because one currency is strong and the other currency is neutral or weak.

Or one currency is weak, and the other currency is neutral or strong. This characteristic is universal for all 28 pairs we follow, plus any other pair for that matter. There is absolutely no other reason to trade a pair looking to profit from the movement. We can trade the most popular 28 pairs because we can see these movements daily on The Forex Heatmap ® forex heatmap. Also we can analyze strength and weakness of trends by reviewing the charts, by individual currency.

So traders would look at all of the JPY pairs together, for example. In the example below we can show traders how to successfully trade this pair, and the same principles apply to trading any of the forex major pairs, or any other pair for that matter.

In the example below or real time indicator, forex 7 major pairs, The Forex Heatmap ® forex heatmaptells you that AUD Australian Dollar is strong and this consistent signal drove price movement on many pairs. Some of these pairs are completely ignored by almost all traders but this turns into a huge opportunity once you understand how the market works. The volatility of the 28 pairs we trade varies quite a bit. Comparing the volatility of one pair to another is easy by looking at the price quote, then subsequently moving a decimal point.

If the bid price is 1. All of the forex major pairs and all 28 pairs we trade pairs can be volatile after related news drivers, even in the Asian session. How currency pairs are quoted varies somewhat.

This takes some getting used to. Just remember that if all three pairs moved up 10 pips each only the two digits on the right would change. The spreads on a currency pair is an indication of the liquidity and daily trading volume of that particular pair. Pairs forex 7 major pairs higher daily trading volumes have lower spreads. The spreads on the forex major pairs is generally lower because the USD has the highest daily trading volume of any currency on the foreign exchange.

So traders can conclude, as forex 7 major pairs general rule, that the lower the spread, the higher the liquidity and daily trading volume of that pair. Look at the spreads on this sampling of 10 out of the all 28 pairs we trade with the Forexearlywarning trading system. This will give you a feel for the liquidity of each pair.

The spreads on the forex major pairs and all 28 pairs we trade are acceptable for daily trading and are only somewhat high on one or two pairs. The spreads you see below are from a major broker for an ECN, direct access brokerage platform. One of the currency pair characteristics that is variable is the pip value, or payout, it varies from pair to pair. The payout is the amount you get paid or lose for 1 pip of movement after you are in a live trade. The value of one pip of movement is always different between currency pairs because there are differences between the exchange rates of different currencies, and the currency your trading account is funded in.

In this case the payout for 1 pip of movement is 1. If your account is funded in another currency you would have to re-calculate the 1 pip payouts on any transaction. Fortunately, rather than having to use a calculator every time, all you have to do is place a trade and the math is worked out in your trading platform. So calculations are not needed, just do some demo trades to see how the values change on any pair and look to see how the profit and loss fluctuates.

Swaps or rollover interest is the amount of interest paid into or debited from forex 7 major pairs account once per day based on the positions you are holding.

Since retail forex trading is leveraged the interest rates must be accounted for, forex 7 major pairs. It varies for all 28 pairs and is dependent on the interest rates in the two currencies involved. If the interest rate differential is high between the currencies the daily swaps can add up. Also, forex 7 major pairs, if the interest rate between the two currencies is similar the daily swaps will be small or negligible. Your broker should be able to provide you with a list of the daily swaps for buys and sells of the forex major pairs and all 28 pairs we trade, forex 7 major pairs.

The interest paid or debited into your account happens automatically and is programmed into the broker trading platform, forex 7 major pairs. So interest rate differential between the two currencies in the pair is a unique characteristic of each currency pair.

Press Releases Currency Options Forex Audio Book. Seminars Proven Forex System Referral Program. Copyright © MT2 Enterprises, LLC. All right reserved.

Forex Trading for Beginners #2: What are the Major Currency Pairs by Rayner Teo

, time: 5:38The 7 Major Forex Currency Pairs in Trading | CMC Markets

Analysis of the Seven (7) Forex Majors. What are the Forex Majors? The Forex Majors are the most liquid currency pairs that contain the US Dollar either on the base side or on the quote side. The majors include seven (7) pairs. 1. EUR/USD (Euro / United States Dollar) 2. USD/JPY (United States Dollar /Japanese Yen) 3 Typically referred to as “The Majors”, these seven currency pairs make up almost 80% of total daily trading volume*. As you’ll see in the table below, the major currency pairs all include the U.S. Dollar (USD) Here are the 7 major currency pairs that make up for most of the trading activity in forex markets: EUR/USD – Fiber Nicknamed “Fiber”, the EUR/USD (euro/US dollar) is the world’s most heavily traded currency pair accounting for 29% of all forex transactions in

No comments:

Post a Comment